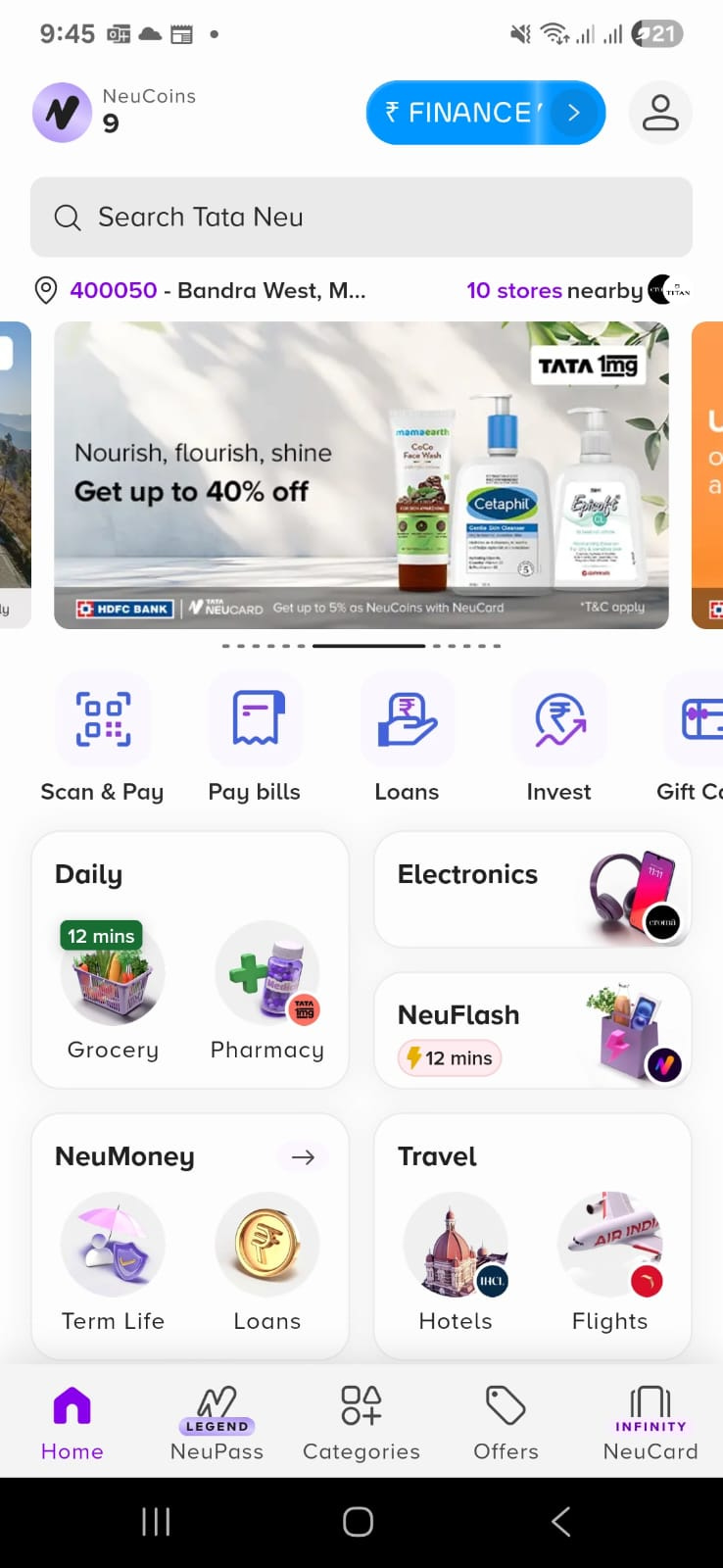

How Tata Neu Built the Stickiest Loyalty App by Rewarding Everything (Not Just Purchases)

How Tata Neu turned loyalty into lifestyle capture and made leaving feel impossible

Last week, my friend had to book a flight. Same price on MakeMyTrip and Tata Neu. Same airline. Same seat.

Guess which one she picked?

Tata Neu.

Why? Because those NeuCoins she'd earn would pay for her groceries at BigBasket next week, her mom's medicines from 1mg, and that laptop she's been eyeing at Croma.

That's when I realized something big: Tata Neu didn't just make a rewards program. They made leaving feel expensive.

Beyond Points: The Ecosystem Play

After studying how Flipkart nailed simplicity and Starbucks added gamification layers, here's how Tata Neu went one step further:

They turned loyalty into lifestyle capture.

Most loyalty programs think like this: "How do we get customers to buy more from us?"

Tata Neu asked: "How do we become essential to how they live?"

The One-Wallet Strategy

Here's what they did differently:

Book flights through Tata Neu → Earn NeuCoins

Buy groceries on BigBasket → Earn NeuCoins

Order medicines from 1mg → Earn NeuCoins

Shop electronics at Croma → Earn NeuCoins

Pay bills, book cabs, buy insurance → All earn NeuCoins

Use those same coins anywhere in their ecosystem.

The insight: Instead of competing for loyalty within one category, they captured loyalty across your entire spending pattern.

The Psychology of Expensive Switching

Here's what happens after 3 months of using Tata Neu:

You have 5,000 NeuCoins sitting in your account. That's real money you can spend across dozens of brands.

Now someone asks you to try a competitor. Your brain immediately calculates: "But then I lose all these coins. And I'd have to start earning from zero somewhere else."

The switching cost becomes psychological.

It's not just about losing points anymore. It's about rebuilding your entire reward strategy from scratch.

Why This Works So Well in India

Indian consumers are portfolio shoppers. We don't buy everything from one place—we optimize across multiple brands based on price, convenience, and value.

Traditional loyalty programs fight this behavior. They want you to be loyal to one brand.

Tata Neu embraced this behavior. They said: "Shop wherever you want within our ecosystem. We'll reward all of it."

The result: You don't stay because you love Tata. You stay because leaving costs too much.

The Ecosystem Effect in Action

Let me show you how this plays out:

Month 1: You try Tata Neu for flight booking. Earn some coins.

Month 2: Those coins expire soon, so you use them for BigBasket groceries. More shopping = more coins.

Month 3: You need medicines. Instead of going to your usual pharmacy, you use 1mg to maximize your existing NeuCoins.

Month 6: You're not consciously "loyal" to any individual Tata brand. But you're deeply integrated into their ecosystem.

The trap is complete.

What This Teaches Product Leaders

Ecosystem-level thinking beats product-level optimization.

While competitors fight for your attention in one category, Tata Neu quietly owns your wallet across categories.

Key lessons:

1. Map the customer journey, not just your product usage What else do your customers spend money on? Can you capture adjacent categories?

2. Design for portfolio behavior, not exclusive loyalty

Indian consumers will never buy everything from one brand. Can you reward their portfolio approach?

3. Make the switching cost psychological, not just financial Points expire. Emotional investment in an ecosystem doesn't.

4. Think horizontally, not vertically Most brands go deeper in their category. Tata went wider across categories.

The GTM Reality

This strategy only works if:

✅ You have access to multiple product categories

✅ Your target customers already shop across those categories

✅ You can maintain quality across the ecosystem

✅ The unit economics work at portfolio level, not product level

Most brands can't pull this off. Tata could because they already owned the supply side across categories.

The Dark Side of Ecosystem Loyalty

For customers: You get better rewards but lose flexibility. Once you're in, rational switching becomes irrational.

For competitors: How do you compete with an entire ecosystem using just one product?

For Tata: If any major brand in the ecosystem fails, the whole network effect weakens.

What's Next for Loyalty

Tata Neu represents the evolution from:

Points-based loyalty (collect and redeem)

To subscription loyalty (pay upfront, save ongoing)

To ecosystem loyalty (integrate lifestyle, make switching expensive)

The question: What comes after ecosystem capture?

Field Notes

The most sophisticated loyalty programs don't feel like loyalty programs at all. They feel like smart financial decisions.

When choosing between apps becomes about "which one saves me more money across my entire lifestyle," you've moved beyond loyalty into dependency.

That's exactly where Tata Neu wants you.

Have you ever found yourself trapped in a loyalty ecosystem? What made switching feel too expensive to consider?